Uh oh...

It appears that you're using a severely outdated version of Safari on Windows. Many features won't work correctly, and functionality can't be guaranteed. Please try viewing this website in Edge, Mozilla, Chrome, or another modern browser. Sorry for any inconvenience this may have caused!

Read More about this safari issue.

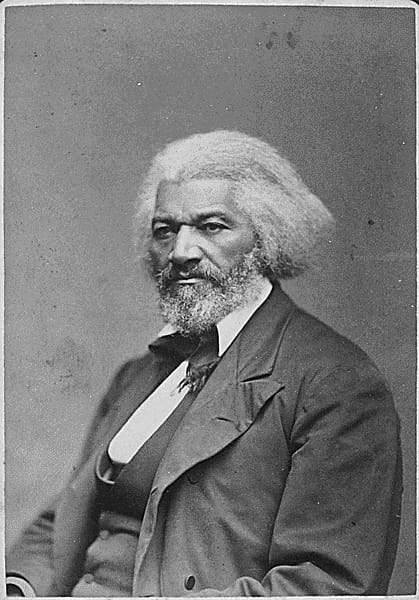

Frederick Douglass is one of the central figures often profiled during Black History Month. Born a slave, Frederick Douglass became one of the foremost black leaders of his time. His work as a writer, orator, and abolitionist played a pivotal role in the movement to emancipate enslaved African Americans in the US. He has long since been acknowledged for his skill as an orator, author, and abolitionist. However, what many may not realize is that Frederick Douglass was also a banker.

As part of the emancipation of enslaved African Americans, President Abraham Lincoln and the US Congress established Freedman’s Savings & Trust Company in 1865 in an effort to incorporate African Americans into the US economy. The bank amassed over $57 million in deposits from around 70,000 African Americans over the course of a decade. The bank operated branches in 17 states, including one in Little Rock, Arkansas, started in June 1870.

After a period of poor management, Frederick Douglass became CEO as part of an attempt to save the bank. Despite investing $10,000 of his own money to aid the effort, Frederick Douglass eventually petitioned Congress to close the bank and return the remaining deposits to the bank’s customers. Though now defunct, the historic institution has since been immortalized as part of a US Treasury building in our nation’s capitol.

Though the bank did not survive, the effort to create Freedman’s Savings & Trust Company showed how critical economic inclusion is to the fabric of our nation. Founded on the heels of emancipation, the bank also showed the potential African Americans had to pool their resources and improve their collective position in US society. Today, minority communities have made tremendous strides in their participation in the US economy. Yet there is still a long way to go considering the levels of unemployment, underemployment, and the need for wealth building within minority communities. Despite this need, the number of black-owned banks in the US continues to decline. In 1986, when Black History Month was established, there were 47 black-owned banks. Today, there are only 24 black-owned banks in operation.

While there may not be a resurgence of black-owned banks, there is great value in ensuring banks across our nation’s communities are led by women and men from a variety of backgrounds. I have written previously about the important role of diversity and an intentional focus on increasing interaction between diverse groups within an organization. The kind of diversity that creates opportunities for individuals to collaborate with others different from themselves is indeed a key competitive advantage.

Banks have long been foundational to the vitality of communities. They have been critical in everything from encouraging saving to financing the launch of small businesses to helping families buy their first home. Having bank leaders who represent the array of backgrounds present in their local communities is important for banks to truly meet the needs of those they serve both today and in years to come.

We do the work.

You check your email.

Sign up for our weekly e-news.

Get stories sent straight to your inbox!

Like this story? Read more from Frank Scott, Jr.

As we celebrate Black History Month, I’m reminded of the role black...

Join the Conversation

Leave a Comment